Every parent dreams of instilling responsibility, financial wisdom, and discipline in their children. However, the modern world, filled with instant access and relentless marketing, makes it incredibly challenging to teach kids the value of money. It’s easy to slip into a pattern of buying the latest gadget or toy to compensate for a busy schedule, often resulting in children who struggle to understand concepts like saving, delayed gratification, and work ethic.

This guide provides a comprehensive, stress-free strategy for integrating financial literacy into your child’s life, starting as early as age five. We will introduce practical systems, such as the allowance method, and explain how to use tools like dedicated debit cards to make saving feel tangible and rewarding. Learning to manage money is not just about financial success; it’s about building the character traits necessary for a stable, independent future. By the end of this article, you will have a clear blueprint to empower your children with strong financial decisions, while strengthening your own family budget in the process.

The Allowance System: Effort vs. Expectation

The allowance is the most powerful tool you have to promote financial literacy and responsibility. It serves as your child’s first bank account, their first budget, and their first taste of earning power. The crucial decision for parents is not whether to give an allowance, but how to structure the allowance to teach the correct values: effort, saving, and managing scarcity.

Allowance Methods: Commission vs. Salary

Parents generally use one of two main allowance models, and their choice sends different messages about work ethic and budgeting:

- Commission Model (Work-Based): The child earns money only for specific, extra chores outside their normal household duties (e.g., washing the car, mowing the lawn).

- Pro: Directly ties money to effort, emphasizing a work ethic and income-generation.

- Con: Can complicate routine family responsibilities (e.g., “I won’t clean my room unless I’m paid”).

- Salary Model (Budgeting-Based): The child receives a fixed amount regularly (e.g., weekly), regardless of completing basic chores. However, they are then responsible for budgeting specific expenses (e.g., buying video games or gifts).

- Pro: Teaches essential cash flow management and forces the child to make trade-offs within a fixed budget.

- Con: Does not directly link money to extra labor.

For maximum financial stability education, a hybrid approach often works best: give a small fixed salary for budgeting practice, and offer extra commission opportunities to teach the work ethic needed for large purchases.

When to Introduce Money (Age)

Introducing a formal allowance system should align with a child’s cognitive development.

- Ages 5–7 (The Counting Stage): This is the ideal time to start. Children can grasp the concept of counting and basic saving. Start with small amounts (e.g., $1 per year of age per week) and focus on using physical money (coins) for immediate, tangible lessons. This establishes the habit early.

- Ages 8–12 (The Banking Stage): This is when children understand delayed gratification and the importance of a bank. Introduce the “Three Jars” method (Saving, Spending, Giving) and consider graduating them to a dedicated kids’ debit card or digital platform to teach real-world tracking and digital money management.

- Ages 13+ (The Digital Stage): Teens should be responsible for larger expenses, such as clothing, entertainment, and gifts. This transition prepares them for college-level budgeting and reinforces the need for a work ethic to supplement their allowance through part-time jobs or commissions.

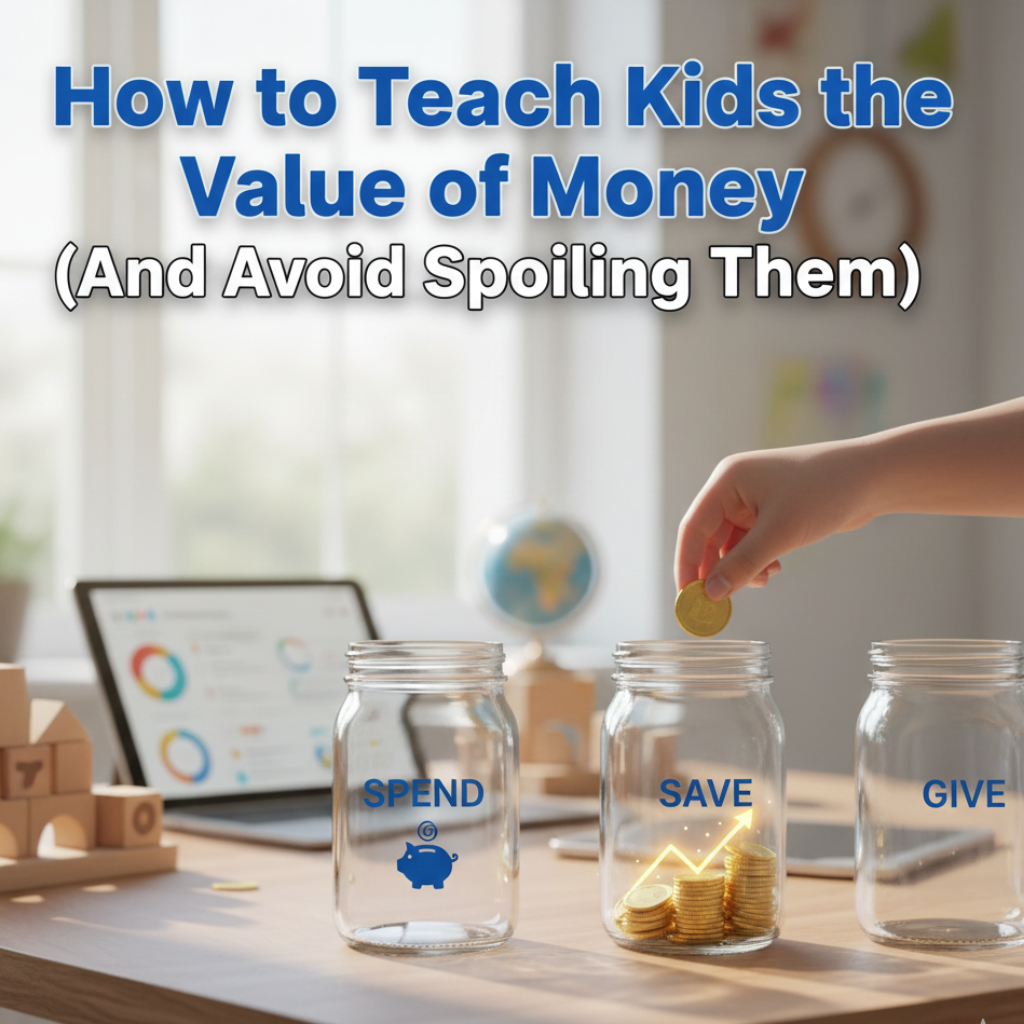

The Three Jars Method: Spend, Save, Give

Once your child begins receiving an allowance, the next critical step is teaching them to allocate that money correctly. The “Three Jars Method” is the most simple and visual way to teach the three pillars of financial well-being: enjoying the present, securing the future, and contributing to the community.

The ‘Spend’ Jar

- Purpose: Immediate gratification and decision-making.

- Recommended Allocation: 50% – 60% of the allowance.

- Key Lessons: This money is for small, impulsive purchases, like candy, trading cards, or a movie ticket. The rule here is: “Once the money is gone, it’s gone.” This teaches the consequences of spending and forces the child to prioritize their wants within their weekly budget.

The ‘Save’ Jar

- Purpose: Delayed gratification and goal setting.

- Recommended Allocation: 30% – 40% of the allowance.

- Key Lessons: This money is dedicated to long-term investment goals, such as a big toy, a bicycle, or a video game console. The child learns to wait and watch their money grow. It’s crucial for parents to supplement this jar with a lesson on compound interest (e.g., parents can promise to match 10% of the quarterly savings).

The ‘Give’ Jar

- Purpose: Altruism and community perspective.

- Recommended Allocation: 10% of the allowance.

- Key Lessons: This money is set aside for a charity, a gift for a friend, or a collection. It teaches your child that money is not only a personal tool but a means of positively impacting the world, fostering empathy and reducing self-centeredness.

Graduating to a High-Yield Account

As your child grows and the “Save” jar amounts become significant, it’s time to transition from physical coins to a real account. Opening a teen savings account or a joint account allows them to experiment with digital banking, see their money earn interest, and practice real-time tracking. This transition is crucial for long-term financial stability.

To make your child’s money work as hard as yours, it is vital to choose the right account. [Consult our guide on The Best HYSA Accounts: Smart Savings for Your Child’s College Fund] to start generating interest today.

Digital Tools for Financial Literacy (App Focus)

As society moves away from cash, financial stability requires that children understand digital money management. It is no longer enough to use physical jars; your child needs exposure to accounts, transfers, and digital spending with parental supervision. This is the next frontier for parents determined to Teach kids the value of money.

Best Debit Cards for Kids

Introducing a supervised debit card is the ideal stepping stone between the ‘Spend’ jar and a full bank account. These are often reloadable cards linked to a parent’s account, giving the child the freedom of digital spending while giving the parent complete control.

- Parental Controls: The key benefit is the ability to track spending in real-time, set limits for specific stores (e.g., block online gaming sites), and instantly turn the card off if it is lost.

- Direct Deposits: These cards allow parents to digitally transfer allowances or commission earnings immediately, reinforcing the concept that money is earned and tracked digitally.

- Keywords:

kids' debit cards,reloadable debit cards for teens.

Budgeting Apps for Teens

Budgeting apps tailored for teens translate the simple ‘Three Jars’ model into a digital interface. These apps are crucial for teens as they begin managing expenses for clothing, gas, or social outings.

- Digital Visualization: Apps visualize money flow through charts and graphs, making abstract concepts like interest and expenses tangible and easy to follow.

- Goal Setting: They allow teens to set specific, aspirational savings goals (e.g., saving for a car or college) and track their progress daily. This promotes delayed gratification better than waiting until the end of the month.

Integrating with the ‘Save’ Jar

When choosing a digital platform, look for one that easily links to a separate savings account, or even better, an HYSA. By making the money transfer easy, you encourage the child to move their “Save” money to a high-interest environment, reinforcing the powerful lesson that money should always be working, even when they are not.

Avoiding Lifestyle Creep & Parental Guilt

You can diligently teach your child the 50/30/20 rule for budgeting and the power of their HYSA, but if they see you constantly buying new, non-essential items, your lessons lose their credibility. The greatest threat to your child’s financial future is not their spending habits; it is yours. This challenge is rooted in two powerful forces: parental guilt and Lifestyle Creep.

The ‘Keeping Up with the Joneses’ Trap

Many parents fall into the trap of overcompensating for being busy by buying the latest toys, upgrading family vacations, or driving more expensive cars. This spending is often driven by a sense of guilt over time lost or by social pressure to keep up with other families at school or in the neighborhood. This cycle of spending undermines the principles of delayed gratification and responsible cash flow management that you are trying to instill in your children. Teaching your children to resist impulse buys must start with you resisting social pressure.

What is Lifestyle Creep? (And Why It Stops Savings)

Lifestyle Creep occurs when an increase in income leads to an automatic, corresponding increase in discretionary spending, leaving no improvement in your savings rate. For example, getting a raise might mean upgrading to a more expensive house or car, instead of increasing your contributions to your long-term investment platforms. This phenomenon silently undermines your financial stability.

As parents, we often fall into the trap of buying the latest toys or upgrading our lifestyle just to keep up with other families at school. We think we are doing it for the kids, but often it’s just our own ego.

In fact, my husband and I struggled with this recently. We fell into a pattern of [Lifestyle Creep where we earned more but saved nothing]. Teaching our kids about money had to start with us fixing our own spending habits first.

Conclusion: Lessons for Life, Not Just the Wallet

Mastering your allowance system and resisting the pressure of Lifestyle Creep are the most powerful ways to promote financial freedom for both you and your children. By implementing the “Three Jars” method and using digital tools, you empower your child to make smart financial decisions and understand the value of delayed gratification. More importantly, by addressing your own spending habits, you model the responsibility necessary for genuine financial stability.

This ongoing effort to Teach kids the value of money creates a generational impact. The money you save by resisting the urge to buy impulsive toys—the money freed up by stopping your own Lifestyle Creep—must now be put to work. It should not sit idly; it should be invested to grow your family’s generational wealth.

You have cleared the way for consistent, long-term growth.

You have mastered budgeting and eliminated wasteful spending. Now, optimize the growth of that money: Read our guide on Passive Investing Guide: Best Long-Term Investment Platforms for Busy Parents.

[…] If you want to ensure your family has a smooth and happy ride into tomorrow, we invite you to explore our next station: Teaching Kids the Value of Money […]

[…] Next Step: A digital card is most effective when paired with a strong financial foundation. [Learn how to Teach Kids the Value of Money] and discover how to raise financially responsible children in a digital […]